Swapalease.com lets car leasers connect Amid failing dot-coms, Web site flourishes

By John Eckberg

The Cincinnati Enquirer

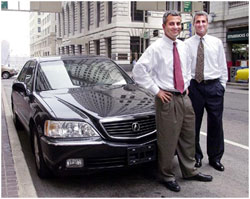

Ronald Joseph Jr. (left) and brother Richard are the masterminds behind swapalease.com, which lets vehicle leaseholders find others to takeover their leases to avoid a large penalty.(Tony Jones photo)

The dot-com meltdown, nationwide layoffs and evaporating pools of venture capital that could have funded competition mean growing revenues and customers for locally based Swapalease.com.

The Internet startup that lets drivers of leased cars end their lease early without a stiff penalty by finding a new leaseholder in cyberspace now has reached every state but Hawaii.

The company, founded last fall, has yet to celebrate its first birthday. It also apparently is insulated from economic ups and downs that haunt other firms.

"This is an idea that works in a humming economy and in a not-so-robust economy," said Robert K. Dorger, director of marketing for Swapalease.com.

"It works in a good economy because people wanted out of their lease for a new car, maybe, or because they wanted to trade up. Now because of what's going on in the economy it's more of a need. There's been a lifestyle change. People have lost their job. They need to get out from under a lease."

Let's make a deal

The company was created in September by brothers Richard S. Joseph, president, and Ronald G. Joseph Jr., chief executive.

As the economy hit a trench, idle e-workers and others looking to chop household expenses turned to Swapalease's Web site.

It works this way: The person who wants to get out of the lease pays $49.95 to list the vehicle indefinitely and a success fee of $95 if a new leaseholder is located. Those looking to lease a car pay $19.95 to become a registered buyer.

That includes a credit application and provides the buyer information to enable them to contact the current leaseholder.

About 1,500 vehicles are listed on the site. Tens of thousands of would-be buyers come to the site every month to look for deals. The biggest spike in visitors came in June, when about 160,000 clicked onto Swapalease.com, up from 30,000 visitors in March.

July posted over 175,000 visitor sessions - a record month.

Richard Joseph said the company will expand to Canada before the end of August with a completely new Canadian site to follow within six months. The Canadian strategy makes sense because a majority of vehicles there are leased by consumers, he said.

Special orders

The Swapalease site has had some special features from the beginning. For instance, shoppers who want a specific type and color of vehicle can ask to be notified by e-mail when one is posted.

The company also will offer a vehicle inspection program and long-range delivery services for consumers who want a car that is several states away. Those initiatives will be launched by the end of this summer.

"We get a lot of good feedback from people, and we act on it," Richard Joseph said.

The executives thought they had a good business plan when the site and company went live, but nobody knew with any degree of certainty whether the effort would work.

"It was like diving into an abyss," Ronald Joseph said. "We knew there would be regular shoppers, and a lot of people look at the site every day to see if anything new is posted."

The pages show pictures, prices and new listings, and can be searched by state or vehicle type, including convertibles, vans, trucks or SUVs.

A cut above

"Theirs is an intriguing idea, and frankly, I'm surprised with their success," said Randall McCathren, president of Bank Lease Consultants, a Nashville- based consulting company that provides advice to the leasing arms of companies like GMAC Financing, Chase Manhattan Bank and Huntington Bank.

He said some factors would have made success a challenge 10 years ago:

- Because used-car values have fallen in recent years, new leasing prices today for a vehicle are going to be substantially higher. "Those prices are maybe 20 percent than they were three years ago," Mr. McCathren said.

- "If you have a lease for $399 for a Ford Expedition and wanted to get a new lease today, it could be $600 or more because residual values have fallen so much," he said.

- The slowing economy has created a higher demand for the service. "Today, there is a huge increase in demand because people are being down-sized and that Internet flop, layoffs in the dot-com world, took a lot of people by surprise," Mr. McCathren said.

- People are not as wary of used-car leases as in the past. Also, because leases typically occurred with only top income earners, in years past, those consumers would not have considered a used car. "There would have been little demand for this service from 1991-95," Mr. McCathren said.

- As venture capitalists watched the dot-com demise of companies like Webvan.com and other Internet-based concerns, they were less likely to invest in firms that might have competed with Swapalease.com.

- That meant the Joseph family had little competition for Web- based re-leasing of vehicles from other startups.

"New way to shop"

Vehicle leases have grown in popularity in recent years with an estimated 15 million cars and light trucks on the highway today being leased vehicles, according to J.D. Power and Associates.

"We've created a whole new way to shop for a vehicle," Mr. Dorger said.

Used-vehicle leasing has increased more than 300 percent in the last five years, and as consumers become more comfortable with the Web, they are no longer as shy about turning to the Internet to make a purchase.

Online car sales will account for one-third of all automobile transactions by 2004, according to Jupiter Communications, while more than 55 percent of new-car buyers use the Internet as part of their shopping.

The two executives are sons of Ronald G. Joseph Sr., owner of Joseph Automotive Group, a top-25 dealer group in the country with 20 franchises in Greater Cincinnati and Dayton, Ohio.

The company was born in a brainstorming session in the Mount Lookout kitchen of Ronald G. Joseph Jr. one evening in the fall of 1998. At the time, the brothers managed car dealerships for the family business and knew the Internet was a wild card. And they wanted it in their deck.

Mr. McCathren said leasing appeals to many consumers because it offers a smaller monthly payment than a typical buy. That in turn allows consumers to invest the difference or perhaps pay down consumer credit.

Back to Articles

Other News...